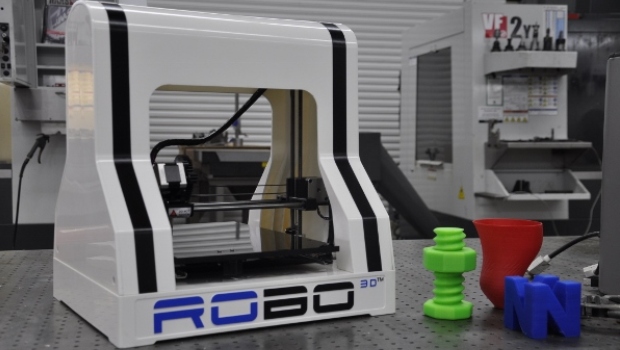

Falcon minerals are all set to acquire 100% ownership of Robo 3D. Robo 3D is a 3D printing manufacturer that supplies affordable and accessible printers in schools and homes. These ownership has been acquired by the issued shares in Albion 3D Investments Pty Ltd.

Anthony Grist is a tech investor who controls Albion 3D Investments.

Falcon Minerals is stationed in West Australia. This takeover is the result of a careful analysis of the growth of Robo 3D in the past year. Robo 3D’s revenue figures were US$4.6 million in June 2016, compared to US$2.4 million over the last year. Robo 3D has announced many new products like new specs on the R2 and R2 Mini 3D printers, the new Robo app, and a new STEM education kit. Their R1 Plus 3D printer has recently appeared in the JeeQ Data Bestselling 3D Printers Online list.

Robo 3D offer its users, affordable desktop and office printers that give quality output. They generate revenues by selling these 3D technologies through Amazon and their own website. They are expanding their sales and their products are now available at Walmart, Best Buy, Costco, Staples, and Target. Braydon Moreno and Coby Kabili, the Co-Founders of Robo 3D are excited at the prospect of their company being listed on the ASX. This would provide them with higher revenues. It will also help them in supplying their printers to many more homes. The Robo3D printers are expected to double their sales in the next three years. They will have 5.6 million users worldwide.

Falcon Minerals is a company engaged in Mineral explorations. 3D printing usage is yet unheard of, in this field. It will be interesting to find out the amalgamation of the two sectors. They are on the verge of making exciting innovations, and we are waiting to hear the news.

Source: 3dprint.com